How Much Money Do You Make With Acx

This is the second in a series of posts about the entrada known to self-publishing authors as #AudibleGate. ALLi would like to extend thanks to Colleen Cross for this mail and for her work with the Fair Deal for Rights Holders and Narrators force per unit area group.

If you haven't already, please sign the #Audiblegate petition hither . We volition go on you posted as the campaign develops. Now over to Colleen, to explain how audiobook authors and narrators are paid.

How Audiobook Authors and Narrators Are Paid

Colleen Cross

As nosotros expect Audible to provide the audiobook returns data requested past authors and narrators since October 2020, information technology's time to question everything well-nigh ACX/Audible "royalty" payments, or lack thereof.

Despite producing and publishing more and more audiobooks, many of the states encounter dramatic decreases in our earnings per audiobook. The thin details on our ACX/Audible "royalty" statements don't provide enough information on returns or other adjustments fabricated to our earnings.

Why?

Information technology appears that Audible's Great Listen Guarantee (GLG), a "free return or exchange" scheme, is cipher more than a disguised lending library cementing Audible'southward monopoly, and paying nothing to authors and narrators, intellectual rights holders and creators.

All of this made me wonder what else besides returns (the subject of a future postal service) is eroding our Audible earnings.

Is the Audible "royalty" adding even fair?

Authors and rights holders invest thousands of dollars in each audiobook produced. "Royalty" Share (RS) narrators invest many hours in commutation for an uncertain time to come compensation. Narrators often accept out-of-pocket production costs as well. It takes many hours to produce one hour of finished audio. Dissimilar authors and narrators, Audible/ACX makes cipher investment in time and money in audiobook product.

Every bit rights holders, many of us expected our upfront investment in audiobooks would lead to hereafter profits. Nosotros further assumed our "royalty" to be based on the Audible retail selling price. That is not the case. Audible bases much of our earnings on what they call a "listener credit".

Then what exercise rights holders earn per Audible listener credit? Short answer: Much less than you lot recollect.

Settle in for the longer answer.

What is ACX'southward Service?

Firstly, for clarity, some facts about Audible/ACX.

ACX is not a split up company from Audible, despite what some ACX customer service reps tell us. ACX.com is simply a website platform operated and controlled past Aural.

ACX offers these services:

- A matching service for narrators and authors. This is rife with scam books and narrators can be left spending hours and weeks on a projection simply to discover it will never be released. Their loss is non only in fourth dimension only production costs.

- Quality control and approval of audio quality prior to sale on Audible. Since 2019, the fourth dimension taken for this has stretched from an advertised 4 weeks to sometimes 9 months. All for books for which payment has already been made or time invested by writer and narrator with "royalty" share. This is potential income loss to authors and creates incertitude with marketing.

- Commitment of the book to Audible, Amazon and Apple Store.

- Calculate and pay "royalties." Audiblegate outlines the issues with their opaque accounting and statements, and returns fraud.

Since ACX simply supplies a service, and Audible is simply a sales platform and retailer where we listing our books, allow'south not call our income "royalties." It's sales income or sales earnings. What nosotros pay Audible should be considered commission. (See ALLi's glossary for more than on this).

This is an of import distinction because 60% and 75% committee at present sounds pretty expensive, right?

Audible Listener (AL) Royalty Category

These are the sales when an Audible fellow member uses a credit to purchase a book and is the 2nd royalty category on your ACX monthly earnings argument. The sales in this "royalty" category have dramatically increased percentage wise vs. the a la card straight sales to non-members, and ALOP (sales to members not using a credit) categories over the last year.

AL is the most profitable category for Aural, and the easiest to manipulate.

The AL category now forms the bulk of rights holder earnings. This is understandable with Audible's ambitious marketing of the value of membership. It's to these aforementioned members Aural markets their "Great Mind Guarantee" to start sell them a subscription and then habituate them to go along. $14.95 for as many audiobooks you like a month? That'due south a great deal for a listener.

Not so keen for authors when this unmonitored scheme is used as a perpetual library-fashion admission to books. Royalties for this category are earned when members redeem a credit, but are clawed back each time a member returns or exchanges an audiobook. Members are led to believe Audible is funding this, not authors. Some even think it's a glitch because it'south almost too practiced to be true.

It'due south all in the subconscious math…

If you've always looked at the Aural ACX contract, y'all've seen the complicated sales earnings math (another futurity post!). For at present, permit's focus just on the result: the amount of coin which ends upwards in your banking concern.

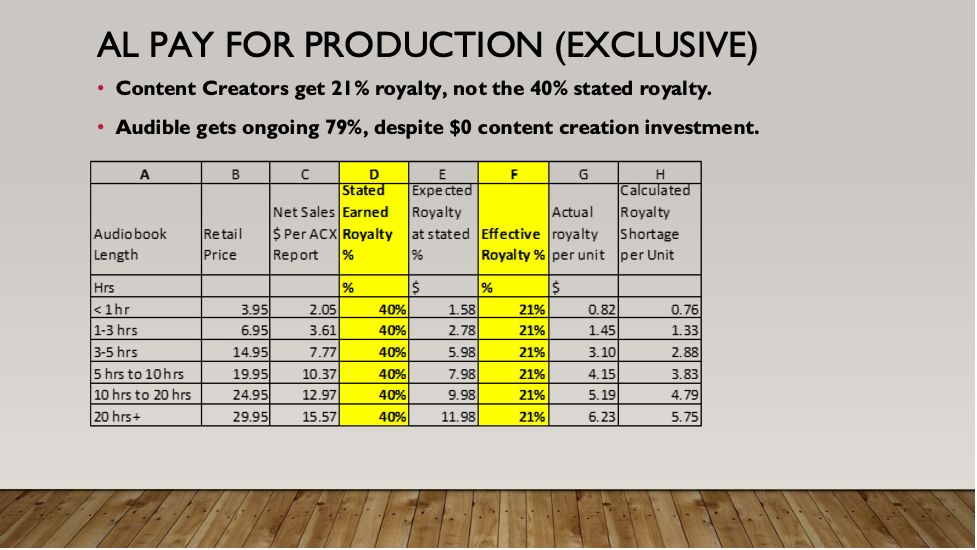

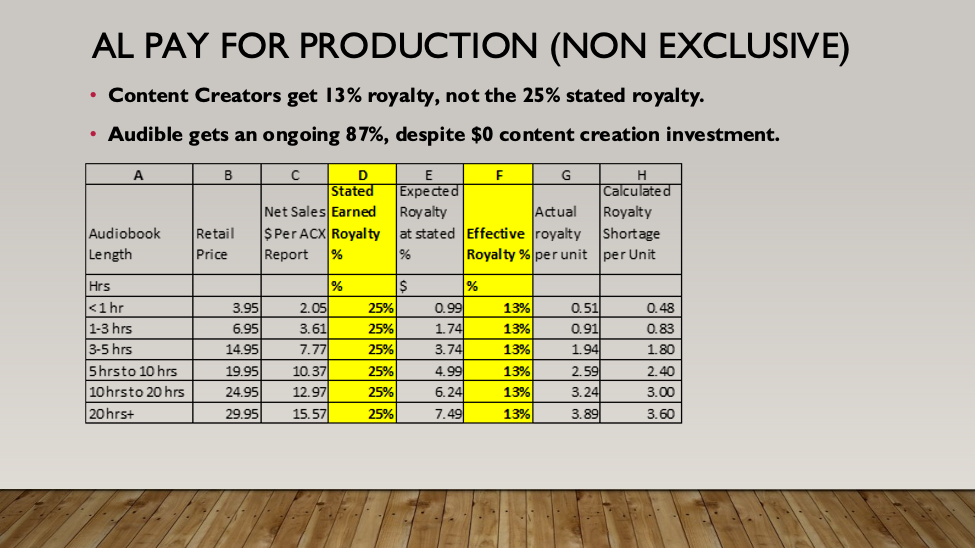

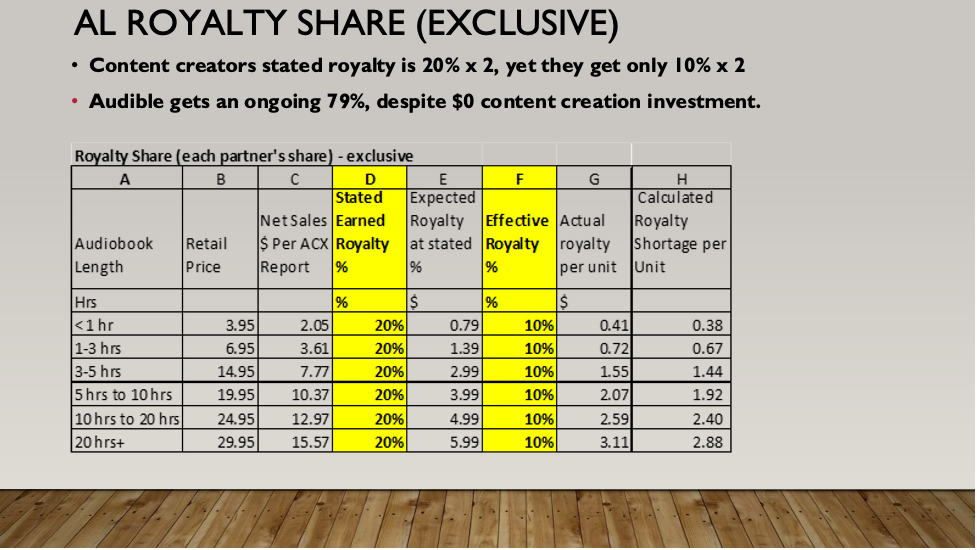

The Audible ACX contract states a 40% "royalty" or 25% "royalty," depending on which Aural distribution selection is agreed, sectional or not-sectional. Cut that percentage in one-half if you lot are in an writer/narrator "royalty share" agreement.

Well, prepare yourself for a nasty surprise.

Information technology's non forty% for sectional pay for production. Information technology's not 25% for non-exclusive. Not even close. I compiled sales data from many Audible authors at different price points and came to the same conclusion for all. Authors are only paid a fraction of the stated "royalty" rate.

Why?

Because sales earnings are not calculated on the selling cost on the Audible store similar Audible implies here:

This leads authors to believe their audiobooks volition primarily sell at the retail price, unless there is an occasional sales promotion. It also implies the selling price is the basis for the "royalty" calculation. Makes sense. Why wouldn't it exist calculated on the retail sales cost? In assessing the viability of turning your books into audiobooks, you'd probable assess the probable payback on your investment, like this:

Toll: Narrator price per finished hr (PFH) of $200 x Audiobook length 7 hours = $i,400

Earnings per audiobook: xl% x $19.95 retail price = $seven.98

Breakeven point: $1400/$7.98 = 175.4 audiobooks

You lot need to sell 175 audiobooks, each earning $7.98 at 40% "royalty," to break even on your $1400 investment.

That's a smart fashion to assess the viability of your audiobook. Unfortunately, it's incorrect!

Audible never pays authors the stated "royalty" rate. Instead, they base the "royalty" on "Net Sales," a number and then heavily manipulated by Aural, that these "Net Sales" adjustments amount to a l% deduction from the retail selling price.

This is the figure upon which authors' share of the sale is calculated. Not retail price.

Does Aural deserve their lion's share cutting?

What, exactly, does Aural do to earn near 50% right off the top, earlier even calculating the split between you and them?

Aural didn't produce the audiobook. They didn't pay the narrator. They certainly didn't write the book. There seems to have been petty investment in the ACX interface since the launch of the company dorsum in 2011. And so, no writer tech investment, either. No caption has been given on the necessity to deduct virtually half the retail toll to arrive at this "Net Sales" amount.

So, permit's do the true ROI adding

Rights holders demand to sympathise the true breakeven bespeak to make informed concern decisions about audiobook production. And so, now let's adjust the math to what the real breakeven point is for this same 7-hour audiobook, using "Net Sales".

Cost: Narrator toll per finished hour (PFH) of $200 x Audiobook length 7 hours = $1,400

Earnings per audiobook: 40% 10 $10.37 Net Sales* = $4.15

Breakeven indicate: $1400/$4.xv = 338 audiobooks

*the actual per unit payment for a 7-hour audiobook, per Audible earnings statement

Based on Audible math, you need to sell 338 audiobooks earlier you lot interruption fifty-fifty on your 7-60 minutes audiobook investment. That's about twice equally much as the 175 audiobooks needed to break fifty-fifty when the "royalty" is based on the Audible retail toll (non Cyberspace Sales).

You demand to sell nearly an audiobook a twenty-four hour period for a yr to earn back your cash outlay, and that'southward only if Audible doesn't lower the price, or allow Aural listeners some of those "Slap-up Mind Guarantee" returns. This represents a huge hurdle before you even make a penny beyond your original investment.

Okay, and so hit me with the real "royalty"!

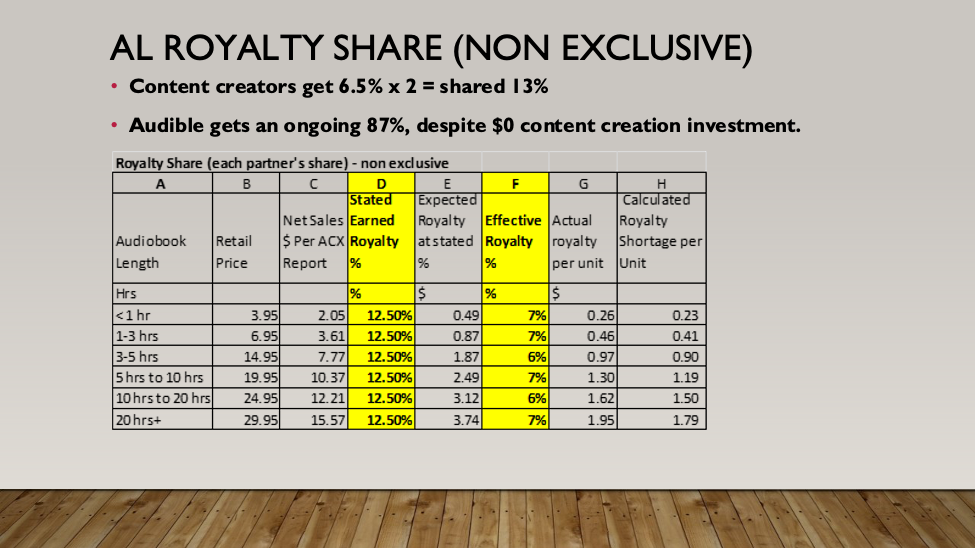

The above example assumes you chose the 40% exclusive to Audible charge per unit. If you lot chose the 25% non-exclusive rate, your earnings—and breakeven point—volition differ. Same if yous are "royalty"-sharing with a narrator. Each "royalty" option is illustrated in the tables below, which compare the stated "royalty" % (what you think you become) vs. the effective "royalty" % (what you actually get).

In this Exclusive, Pay for Production instance on a 7-hour book, y'all only received a 21% "royalty", not the 40% stated "royalty" rate.

Apologies for the math. Painful as information technology is, information technology'south best to be fully informed before you lock yourself into a seven-year contract with a business partner who makes all the rules and takes 79-87% of the money.

A further alert if you think non-sectional is the reply…

Many authors are now deciding to produce audiobooks on non-ACX platforms. Others have postponed or even stopped audiobook production birthday. If you decide to produce audiobooks elsewhere, please be aware nigh or all other audiobook distributors also utilise ACX or they employ a average contract the same as ACX's to publish to Audible, yous volition too be subject to the same sales earnings and losses from returns less the distributor cut.

Enquire what terms apply on audiobooks they distribute to Audible…

If instead yous choose to sell your audio rights to an audiobook publisher, be aware they are also likely locked in to the ACX contract. Inquire them about Aural terms before signing a contract. Besides know that the publisher royalty rates are a per centum of a percentage. For example, a 30% royalty charge per unit will exist 30% times the ACX non-exclusive charge per unit of xiii%, which amounts to less than 4% of retail price. Whatever route yous take, ensure you are fully informed. Do the math if you paid for the product yourself. How much quicker would you own the book and be making clear profit?

Now the math:

See the tables at the end of this post to determine the net sales earnings y'all will receive under the four types if you contract straight with ACX.

Now you are informed and can brand business concern decisions based on fact. It's time for Audible to adequately compensate the content providers who supply the majority of Audible audiobook content. Authors and narrators deserve to be paid fairly for their work. That's all nosotros inquire.

Audible, are you listening?

Audible "Royalty" Tables

Source: https://selfpublishingadvice.org/how-audiobook-authors-are-paid-by-audible-acx/

Posted by: whitespenth.blogspot.com

0 Response to "How Much Money Do You Make With Acx"

Post a Comment